Conscious

Alternative

Asset

Management

At Conscious Alternative Asset Management (CAAM), we focus on transformative investments that drive human evolution and offer profitable returns. Join us as we discover a world of consciously curated alternative investment opportunities focusing on human evolution with the potential for profitable returns.

Transformative Investments

Consciously Curated Alternative

Private Asset Investment

Active Investments

- Emerging Markets: Entrepreneurs creating significant employment opportunities. (Untapped Global)

- Regenerative Agriculture: Pioneers leading regenerative sustainable farming practices. (Trailhead Capital)

- Preservation: Marine geologists dedicated to ocean exploration and preservation. (OMEX)

- Enhancing Environmental Health: Drone technology for reforesting national parks. (Massive VC)

- Reducing single-use plastics: Innovations in US sports stadiums through aluminum water bottles. (Massive VC)

Future Investments

- Renewable Energy Development: Utility-scale renewable energy development.

- Enhancing mental health and human potential through genomic, organic, educational, virtual reality, and AI-enabled technologies designed to elevate human consciousness

- Innovating in water distribution and technology.

- Pioneering food innovation and agricultural technology.

- On-chain innovations creating new value flows.

Our Story & Philosophy

Our Core Principles

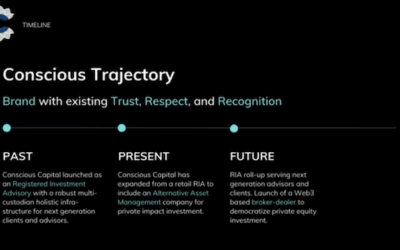

CAAM is an evolution of Conscious Capital that focuses on private asset management

At CAAM, we believe in the power of strategic investment to foster progress and prosperity. We are committed to identifying and nurturing ventures that are not just promising but transformative, ensuring a balance of innovation and profitability.

Building on the foundation of Conscious Capital Wealth Management, CAAM represents the next step in private asset management. Lawrence Ford and his team are at the forefront of vetting and packaging private impact investments, with plans to unveil a broker-dealer in the Web3 space.

OUR QUEST

Innovation

Working with innovative geniuses – asset managers, entrepreneurs, and institutions pushing humanity forward.

OUR GUIDE

Pragmatisim

Committing to projects with strong potential for financial surplus, grounded in evidence-based strategies.

OUR FOCUS

Risk Mastery

Navigating the nuanced layers of risk in alternative investments with precision. Blending traditional risk analysis with an innovative approach.

Investments & Partnerships

Our investment themes

prioritize key sectors:

Human Progress initiatives, aiding poverty alleviation and entrepreneurship.

Responsible AI for

societal benefit and industrial efficiency.

Financial Innovation and FinTech, including Web3 and distributed ledger technology.

Food and Water innovations, including regenerative agriculture and clean water access

Renewable energy and technology infrastructure.

Regenerative Supply Chain focusing on waste removal & circular economy development.

Evolutionary Health and Wellness, including genomics and bio-tech.

News & Blog

Recent Updates

UNTAPPED with Jim Chu

https://vimeo.com/872856461/43c2677608

Capital For Good

https://youtu.be/DX8C4BK7Lik

Invitation: Lawrence Ford

A Word from Lawrence Ford, CEO:“Financial capital isn’t merely a tool – it’s a testament to human ingenuity and ambition. As we tread this remarkable epoch on our planet, it’s imperative to channel our capital consciously. At CAAM, we guide you in harmonizing your...